Kairong Xiao

Reasoning Models Ace the CFA Exams

Dec 09, 2025

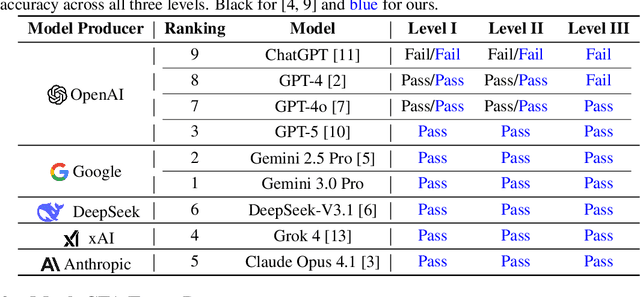

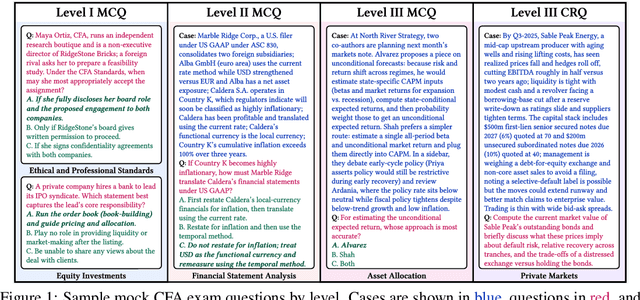

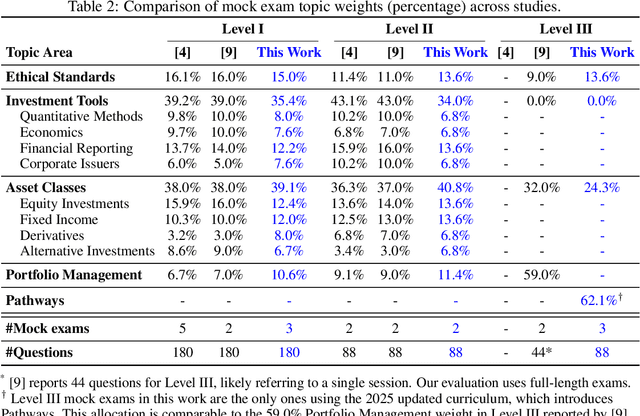

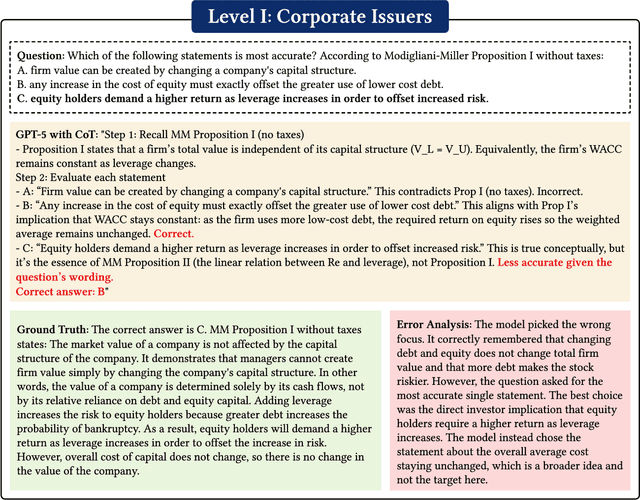

Abstract:Previous research has reported that large language models (LLMs) demonstrate poor performance on the Chartered Financial Analyst (CFA) exams. However, recent reasoning models have achieved strong results on graduate-level academic and professional examinations across various disciplines. In this paper, we evaluate state-of-the-art reasoning models on a set of mock CFA exams consisting of 980 questions across three Level I exams, two Level II exams, and three Level III exams. Using the same pass/fail criteria from prior studies, we find that most models clear all three levels. The models that pass, ordered by overall performance, are Gemini 3.0 Pro, Gemini 2.5 Pro, GPT-5, Grok 4, Claude Opus 4.1, and DeepSeek-V3.1. Specifically, Gemini 3.0 Pro achieves a record score of 97.6% on Level I. Performance is also strong on Level II, led by GPT-5 at 94.3%. On Level III, Gemini 2.5 Pro attains the highest score with 86.4% on multiple-choice questions while Gemini 3.0 Pro achieves 92.0% on constructed-response questions.

Revisiting Ensemble Methods for Stock Trading and Crypto Trading Tasks at ACM ICAIF FinRL Contest 2023-2024

Jan 18, 2025

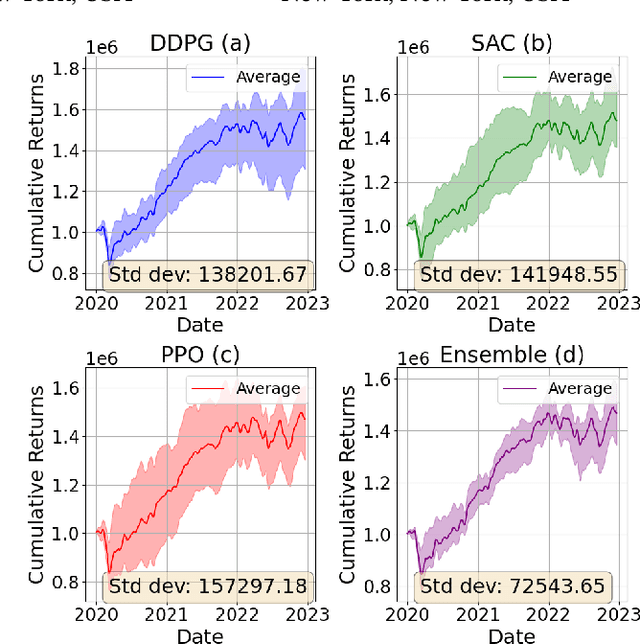

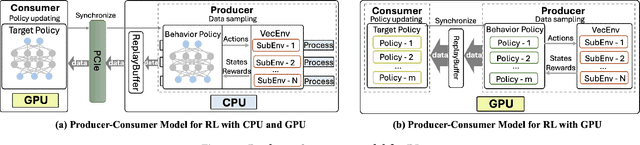

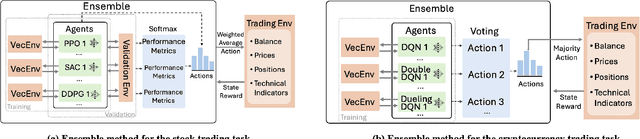

Abstract:Reinforcement learning has demonstrated great potential for performing financial tasks. However, it faces two major challenges: policy instability and sampling bottlenecks. In this paper, we revisit ensemble methods with massively parallel simulations on graphics processing units (GPUs), significantly enhancing the computational efficiency and robustness of trained models in volatile financial markets. Our approach leverages the parallel processing capability of GPUs to significantly improve the sampling speed for training ensemble models. The ensemble models combine the strengths of component agents to improve the robustness of financial decision-making strategies. We conduct experiments in both stock and cryptocurrency trading tasks to evaluate the effectiveness of our approach. Massively parallel simulation on a single GPU improves the sampling speed by up to $1,746\times$ using $2,048$ parallel environments compared to a single environment. The ensemble models have high cumulative returns and outperform some individual agents, reducing maximum drawdown by up to $4.17\%$ and improving the Sharpe ratio by up to $0.21$. This paper describes trading tasks at ACM ICAIF FinRL Contests in 2023 and 2024.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge