Yu-Chien Huang

Quantum Machine Learning, Quantitative Trading, Reinforcement Learning, Deep Learning

Sep 11, 2025

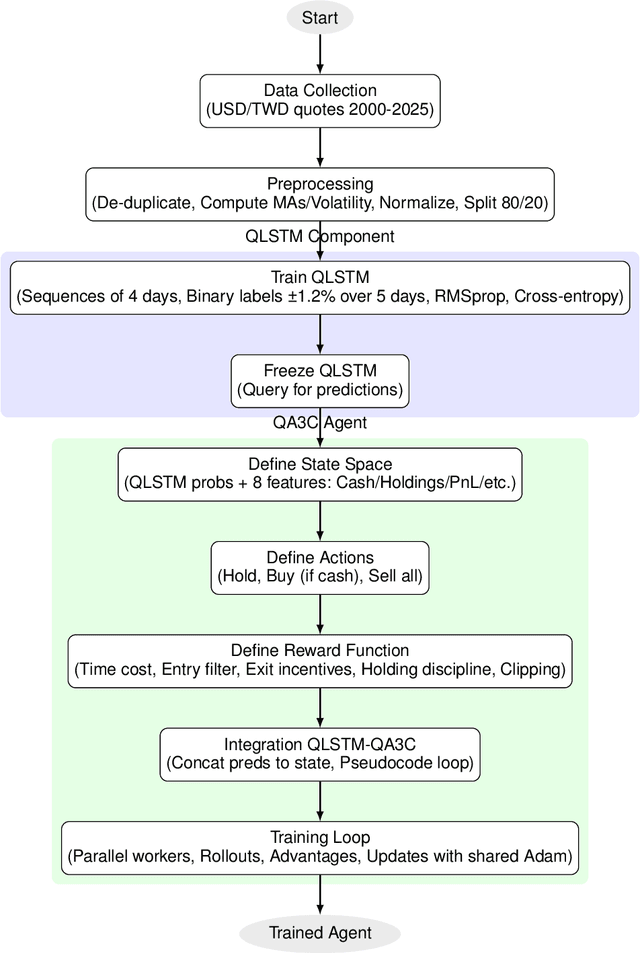

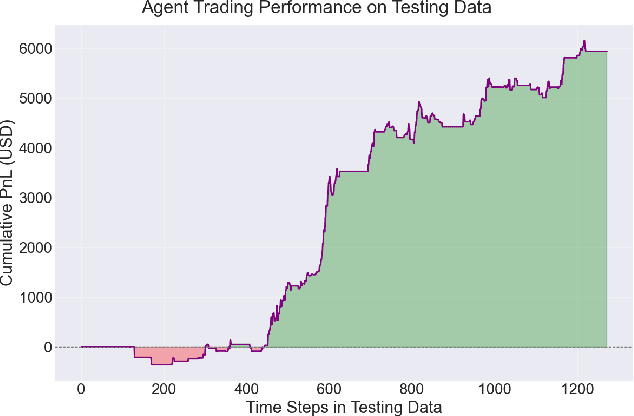

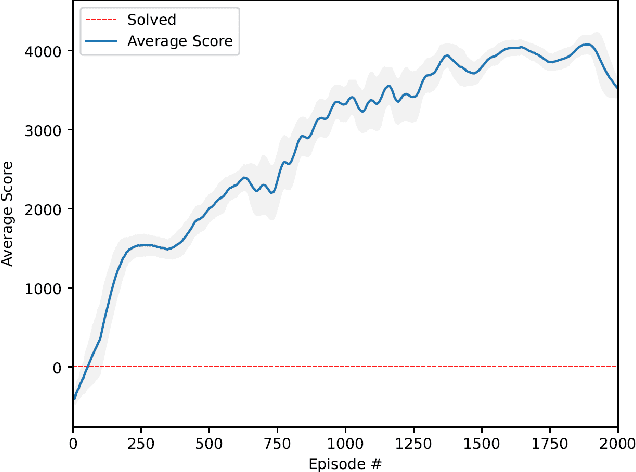

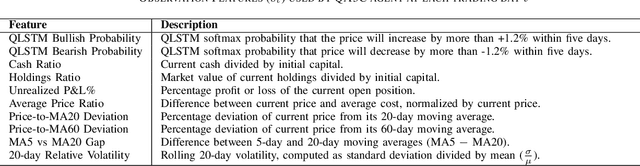

Abstract:The convergence of quantum-inspired neural networks and deep reinforcement learning offers a promising avenue for financial trading. We implemented a trading agent for USD/TWD by integrating Quantum Long Short-Term Memory (QLSTM) for short-term trend prediction with Quantum Asynchronous Advantage Actor-Critic (QA3C), a quantum-enhanced variant of the classical A3C. Trained on data from 2000-01-01 to 2025-04-30 (80\% training, 20\% testing), the long-only agent achieves 11.87\% return over around 5 years with 0.92\% max drawdown, outperforming several currency ETFs. We detail state design (QLSTM features and indicators), reward function for trend-following/risk control, and multi-core training. Results show hybrid models yield competitive FX trading performance. Implications include QLSTM's effectiveness for small-profit trades with tight risk and future enhancements. Key hyperparameters: QLSTM sequence length$=$4, QA3C workers$=$8. Limitations: classical quantum simulation and simplified strategy. \footnote{The views expressed in this article are those of the authors and do not represent the views of Wells Fargo. This article is for informational purposes only. Nothing contained in this article should be construed as investment advice. Wells Fargo makes no express or implied warranties and expressly disclaims all legal, tax, and accounting implications related to this article.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge