Suting Hong

The Gaining Paths to Investment Success: Information-Driven LLM Graph Reasoning for Venture Capital Prediction

Dec 29, 2025Abstract:Most venture capital (VC) investments fail, while a few deliver outsized returns. Accurately predicting startup success requires synthesizing complex relational evidence, including company disclosures, investor track records, and investment network structures, through explicit reasoning to form coherent, interpretable investment theses. Traditional machine learning and graph neural networks both lack this reasoning capability. Large language models (LLMs) offer strong reasoning but face a modality mismatch with graphs. Recent graph-LLM methods target in-graph tasks where answers lie within the graph, whereas VC prediction is off-graph: the target exists outside the network. The core challenge is selecting graph paths that maximize predictor performance on an external objective while enabling step-by-step reasoning. We present MIRAGE-VC, a multi-perspective retrieval-augmented generation framework that addresses two obstacles: path explosion (thousands of candidate paths overwhelm LLM context) and heterogeneous evidence fusion (different startups need different analytical emphasis). Our information-gain-driven path retriever iteratively selects high-value neighbors, distilling investment networks into compact chains for explicit reasoning. A multi-agent architecture integrates three evidence streams via a learnable gating mechanism based on company attributes. Under strict anti-leakage controls, MIRAGE-VC achieves +5.0% F1 and +16.6% PrecisionAt5, and sheds light on other off-graph prediction tasks such as recommendation and risk assessment. Code: https://anonymous.4open.science/r/MIRAGE-VC-323F.

LLM Agents as VC investors: Predicting Startup Success via RolePlay-Based Collective Simulation

Dec 27, 2025Abstract:Due to the high value and high failure rate of startups, predicting their success has become a critical challenge across interdisciplinary research. Existing approaches typically model success prediction from the perspective of a single decision-maker, overlooking the collective dynamics of investor groups that dominate real-world venture capital (VC) decisions. In this paper, we propose SimVC-CAS, a novel collective agent system that simulates VC decision-making as a multi-agent interaction process. By designing role-playing agents and a GNN-based supervised interaction module, we reformulate startup financing prediction as a group decision-making task, capturing both enterprise fundamentals and the behavioral dynamics of potential investor networks. Each agent embodies an investor with unique traits and preferences, enabling heterogeneous evaluation and realistic information exchange through a graph-structured co-investment network. Using real-world data from PitchBook and under strict data leakage controls, we show that SimVC-CAS significantly improves predictive accuracy while providing interpretable, multiperspective reasoning, for example, approximately 25% relative improvement with respect to average precision@10. SimVC-CAS also sheds light on other complex group decision scenarios.

Graph Neural Network Based VC Investment Success Prediction

May 25, 2021

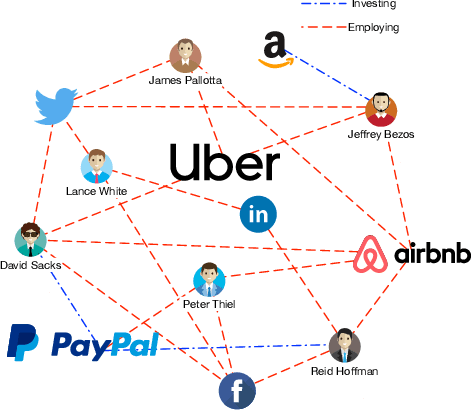

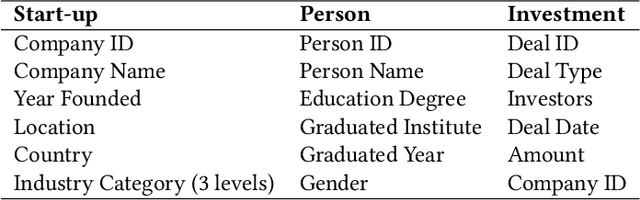

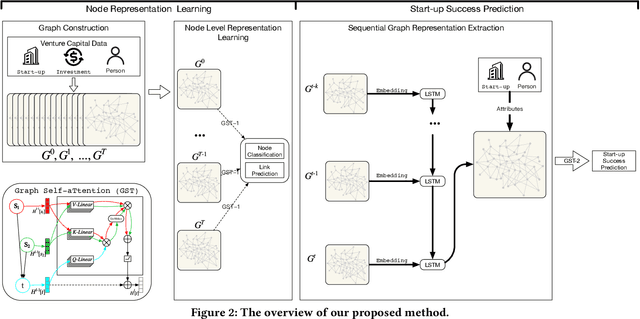

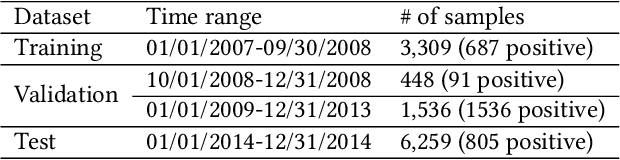

Abstract:Predicting the start-ups that will eventually succeed is essentially important for the venture capital business and worldwide policy makers, especially at an early stage such that rewards can possibly be exponential. Though various empirical studies and data-driven modeling work have been done, the predictive power of the complex networks of stakeholders including venture capital investors, start-ups, and start-ups' managing members has not been thoroughly explored. We design an incremental representation learning mechanism and a sequential learning model, utilizing the network structure together with the rich attributes of the nodes. In general, our method achieves the state-of-the-art prediction performance on a comprehensive dataset of global venture capital investments and surpasses human investors by large margins. Specifically, it excels at predicting the outcomes for start-ups in industries such as healthcare and IT. Meanwhile, we shed light on impacts on start-up success from observable factors including gender, education, and networking, which can be of value for practitioners as well as policy makers when they screen ventures of high growth potentials.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge