Hannes Wallimann

Business analytics meets artificial intelligence: Assessing the demand effects of discounts on Swiss train tickets

May 19, 2021

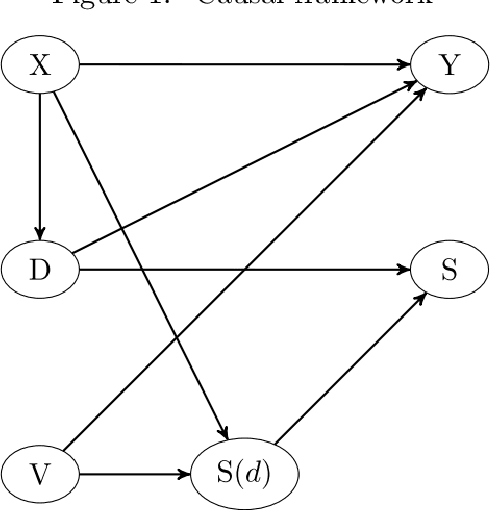

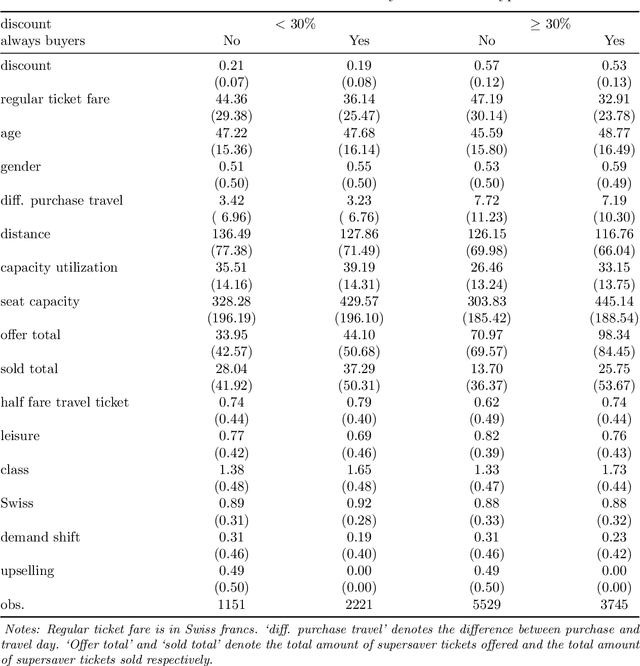

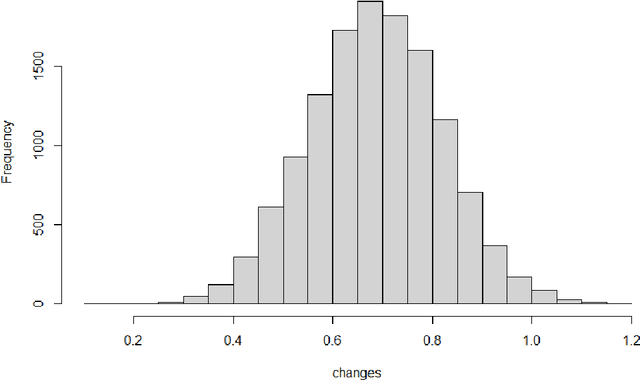

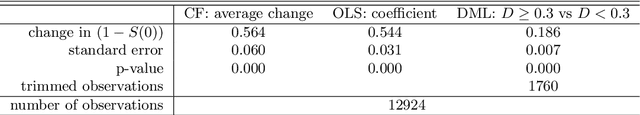

Abstract:We assess the demand effects of discounts on train tickets issued by the Swiss Federal Railways, the so-called `supersaver tickets', based on machine learning, a subfield of artificial intelligence. Considering a survey-based sample of buyers of supersaver tickets, we investigate which customer- or trip-related characteristics (including the discount rate) predict buying behavior, namely: booking a trip otherwise not realized by train, buying a first- rather than second-class ticket, or rescheduling a trip (e.g.\ away from rush hours) when being offered a supersaver ticket. Predictive machine learning suggests that customer's age, demand-related information for a specific connection (like departure time and utilization), and the discount level permit forecasting buying behavior to a certain extent. Furthermore, we use causal machine learning to assess the impact of the discount rate on rescheduling a trip, which seems relevant in the light of capacity constraints at rush hours. Assuming that (i) the discount rate is quasi-random conditional on our rich set of characteristics and (ii) the buying decision increases weakly monotonically in the discount rate, we identify the discount rate's effect among `always buyers', who would have traveled even without a discount, based on our survey that asks about customer behavior in the absence of discounts. We find that on average, increasing the discount rate by one percentage point increases the share of rescheduled trips by 0.16 percentage points among always buyers. Investigating effect heterogeneity across observables suggests that the effects are higher for leisure travelers and during peak hours when controlling several other characteristics.

A Machine Learning Approach for Flagging Incomplete Bid-rigging Cartels

Apr 12, 2020

Abstract:We propose a new method for flagging bid rigging, which is particularly useful for detecting incomplete bid-rigging cartels. Our approach combines screens, i.e. statistics derived from the distribution of bids in a tender, with machine learning to predict the probability of collusion. As a methodological innovation, we calculate such screens for all possible subgroups of three or four bids within a tender and use summary statistics like the mean, median, maximum, and minimum of each screen as predictors in the machine learning algorithm. This approach tackles the issue that competitive bids in incomplete cartels distort the statistical signals produced by bid rigging. We demonstrate that our algorithm outperforms previously suggested methods in applications to incomplete cartels based on empirical data from Switzerland.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge